Non-Executive

Roles

From acquisition to exit

active advisory board or fractional operating partner work that creates value

In addition to my work as an interim executive, I support private equity and family office investors and their portfolio companies as an active advisory board member or a fractional operating partner.

My approach deliberately differs from the classic passive advisory role: I accompany the investment throughout the entire investment cycle – and actively support management as a coach in every phase. In doing so, I contribute my experience from a large number of similar projects.

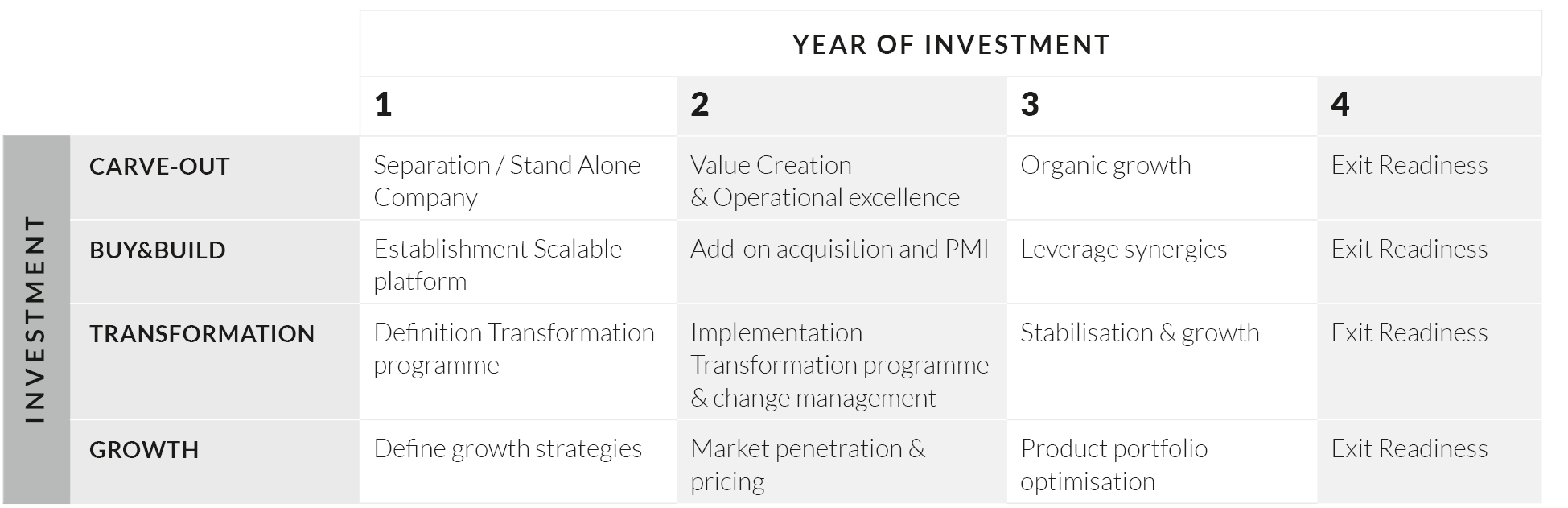

Depending on the investment hypothesis – carve-out, buy & build, transformation or growth – I take on a clearly defined role in implementing the performance improvement measures: from strategic alignment and operational excellence to exit readiness.

This is not about supervision, but about active participation – as a sparring partner for management, a source of inspiration for investors and a guarantor of transparency, focus and commitment to results.

The added value: an advisory board that speaks the language of investors as well as that of operational management – and brings both sides together on a clear, predictable path to value enhancement.

A systematic approach to value creation depending on the investment hypothesis.

Every investment has its own dynamics, specific challenges and individual rhythm. It is crucial to recognise these early on – and to apply the right levers at every stage to create and secure value.

I would be happy to discuss with you how long-term support can be structured in concrete terms to specifically support and accelerate your investment and secure its success over the entire holding period.

Let’s talk about your portfolio. ‘Would you like to actively develop your portfolio? I look forward to hearing from you.’

Traditional advisory boards provide external commentary. I am part of the team and actively drive the investment case forward.

Oliver Fausten

Traditional advisory boards provide external commentary. I am part of the team and actively drive the investment case forward.

Oliver Fausten